Top Guidelines Of Offshore Business Formation

Table of Contents10 Easy Facts About Offshore Business Formation DescribedOffshore Business Formation - TruthsSome Known Factual Statements About Offshore Business Formation Not known Facts About Offshore Business FormationLittle Known Questions About Offshore Business Formation.The smart Trick of Offshore Business Formation That Nobody is Discussing

In enhancement, the business will be needed to report its around the world earnings on its residence nation's tax obligation return. The procedure of setting up an offshore firm is more intricate than developing a normal company.

Establishing up an offshore company does not provide any savings given that you still pay tax on your worldwide income. If you intend to lower your international tax obligation worry, you should consider establishing several companies as opposed to one offshore entity. When you relocate money out of an overseas place, you will be responsible for that income in your home country.

Facts About Offshore Business Formation Revealed

The trade-off is that offshore business sustain fees, expenses, and also various other cons. If you intend to integrate offshore, then you ought to know regarding the pros and also disadvantages of including offshore. Every area as well as territory is different, and also it's hard to really understand real efficacy of an overseas firm for your organization.

If you want evaluating Hong Kong as an option, call us to learn more as well as among our specialists will walk you through Hong Kong as an offshore incorporation alternative (offshore business formation).

Discover the advantages and disadvantages of establishing an overseas business, consisting of personal privacy and minimized tax responsibility, and also discover how to sign up, establish, or incorporate your organization beyond your country of home. In this post: Offshore companies are companies registered, developed, or included beyond the nation of house.

Offshore Business Formation for Dummies

If a legal opponent is pursuing lawful action versus you, it typically involves an asset search. This guarantees there is cash for payments in the occasion of a negative judgment against you. Creating offshore companies as well as having properties held by the abroad company indicate there is no longer a link with your name.

A fringe benefit is simplicity as well as ease of operation. Many overseas territories make it easy for any individual to integrate. The statutory obligations in the running of the offshore entity have actually additionally been streamlined (offshore business formation). Due to the absence of public signs up, showing possession of a company signed up offshore can be challenging.

One of navigate to these guys the major drawbacks is in the location of remittance as well as distribution of the assets as well as income of the offshore firm. As soon as monies reach the resident nation, they are subject to taxation. This can negate the advantages of the first tax-free setting. Dividend earnings received by a Belgian holding business from a company based in other places (where revenue from foreign sources is not strained) will certainly pay corporate earnings tax obligation at the normal Belgian price.

All about Offshore Business Formation

In Spain, withholding tax obligation of 21% is payable on passion and also returns payments, whether residential or to non-treaty countries. Nevertheless, where rewards are paid to a business that has share capital that has actually been held during the previous year equivalent to or above 5% holding back tax does not use. This suggests that tax is subtracted before monies can be remitted or transferred to an overseas firm.

The primary thrust of the legislation is in forcing such companies to show past a practical uncertainty that their hidden tasks are genuinely accomplished in their particular offshore facility which these are indeed regular service tasks. There are huge tax obligation threats with carrying out non-Swiss firms from beyond Switzerland, for example.

A further consideration is that of reputational danger - offshore business formation.

3 Simple Techniques For Offshore Business Formation

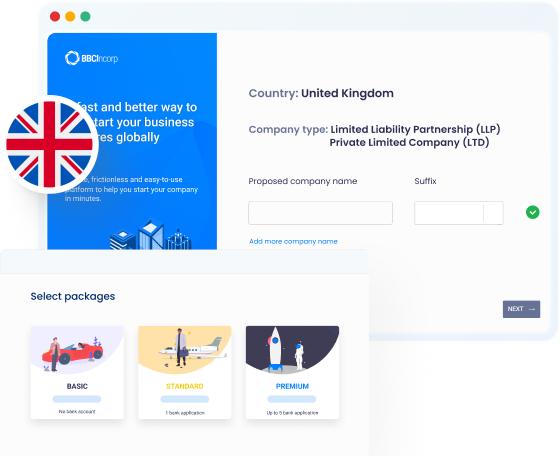

The overseas business enrollment process need to be carried out in full supervision of a business like us. The need of choosing offshore firm registration process is essential prior to setting up a business. As it is called for to satisfy all the problems after that one should describe a proper organization.

Take benefit of no taxes, accountancy and also auditing, as well as a totally transparent, reduced investment endeavor. When picking a procedure that calls for proper focus while the satisfaction of rules and also guidelines then it is essential to comply with blog certain steps like the solutions supplied in Offshore Company Development. For more details, please total our and also an agent will certainly be in contact eventually.

India, China, the Philippines, Poland, Hungary, Ukraine, Brazil, Argentina, Egypt, as well as South Africa are a few of the finest nations for overseas advancement.

The Best Guide To Offshore Business Formation

There are several reasons that business owners may have an interest in establishing an offshore company: Tax advantages, reduced compliance costs, a helpful banking atmosphere, and new profession opportunities are several of one of the most commonly mentioned reasons for doing so. Here we take a look at what entrepreneurs require to do if they want to establish a Hong Kong overseas company (offshore business formation).

This Full Article is because: There is no need for the business to have Hong Kong resident directors (an usual demand in other nations) as Hong Kong takes on a plan that prefers offshore companies established by international capitalists. offshore business formation. There is no need for the business to have Hong Kong resident shareholders either (an usual need elsewhere) foreign business owners do not need to partner with a neighborhood citizen to process a Hong Kong firm arrangement.